US stocks set a record close on Monday after biotech group Moderna lifted global markets with trial data that showed its coronavirus vaccine was highly effective.

Wall Street’s benchmark S&P 500 index ended the day up 1.2 per cent while the Russell 2000 of US small-cap stocks — seen as a barometer of the domestic economy — also closed at a record. The tech-heavy US Nasdaq Composite advanced a more modest 0.8 per cent.

Hopes that a successful vaccine could be deployed to slow the spread of coronavirus in as little as a few months triggered a powerful rotation into economically sensitive sectors that began last week, as investors moved away from groups perceived as beneficiaries of the pandemic.

“That’s a reflection of increased likelihood of and visibility into the normalisation of corporate profits and lifestyles in 2021,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors.

The announcement that Moderna’s vaccine was 94.5 per cent effective in preventing the disease for participants in a late-stage trial followed a similar result for a similar product from Pfizer and BioNTech a week earlier.

The stock market rotation continued on Monday, with energy and financial stocks leading gains on both sides of the Atlantic. Travel stocks also benefited with shares in the biggest US airlines up between 4 and 5 per cent, and cruise lines gaining even more.

“Visibility towards a return to normality is increasing, and this should provide more fuel to the reflation rally, with small-caps, value and cyclicals clear beneficiaries,” said Seema Shah, chief strategist at Principal Global Investors.

Hani Redha, a portfolio manager at PineBridge Investments, said money that investors had left on the sidelines — while they awaited greater certainty over issues such as the pandemic and the US election — was likely to flow into sectors that would benefit most from the recovery, but added that he did not expect to see “a sell-off in the other sectors”.

“Any selling of any particular sector — let alone tech, which has such strength behind it — is going to be very shortlived . . . The broader tech sector is not beholden to lockdown versus no lockdown,” he added.

“The Pfizer news was the big step-change but this clearly helps,” said Chris Jeffery, a fixed-income strategist at Legal & General Investment Management. “The more vaccines that get over the line, the faster the rollout in aggregate is going to be in the first few months of next year.”

Moderna said its vaccine would remain stable once thawed for 30 days when refrigerated at between 2C and 8C for 30 days, longer than the BioNTech-Pfizer shot, which can survive in a normal fridge for only up to five days and must otherwise be stored at minus 75C.

Moderna shares were up 11 per cent, while Pfizer fell 4 per cent.

In Europe, the Stoxx 600 index closed 1.2 per cent higher, while London’s FTSE 100 rose 1.7 per cent. A rally in oil prices was also extended by the Moderna news, with international standard Brent crude up 2.5 per cent at $43.90 a barrel, although off the day’s highs. West Texas Intermediate, the US marker, was up 3 per cent at $41.39 a barrel.

US government bonds declined in price as investors placed their bets instead on more solid growth and inflation on the horizon. The 10-year Treasury yield was up 0.016 percentage points at 0.909 per cent.

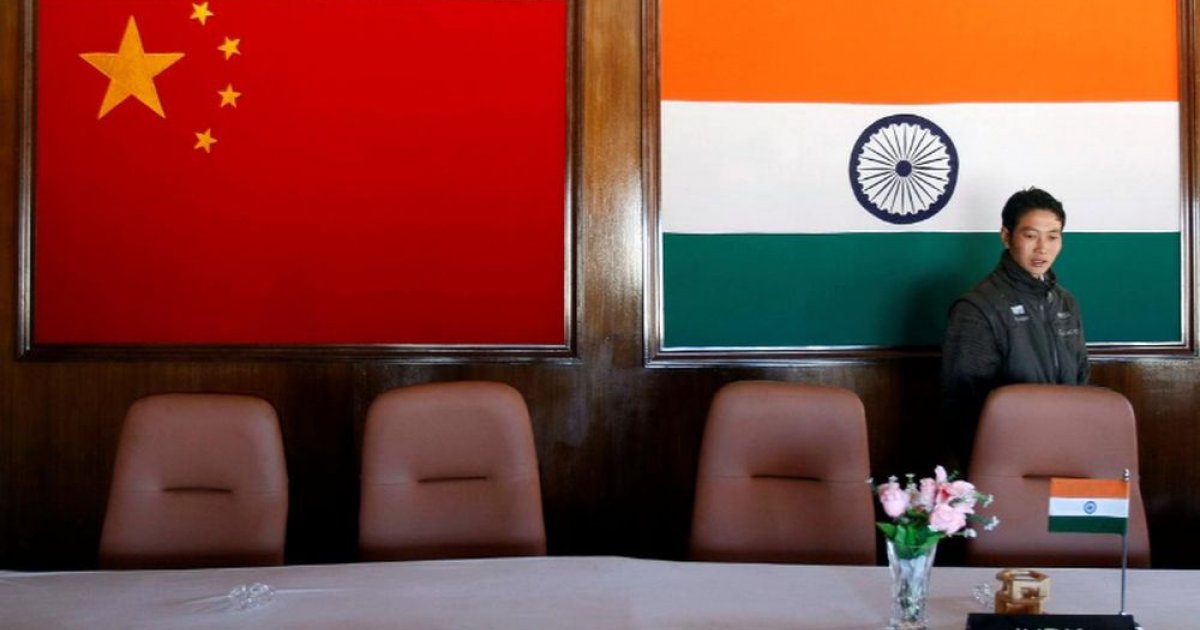

Markets were also boosted on Monday after 15 nations, including China, Japan, Australia and Malaysia, signed one of the biggest trade agreements in history.

MSCI’s index of Asia-Pacific shares, excluding Japan, rose more than 1 per cent to a record high, while Japan’s Topix advanced 1.7 per cent and China’s CSI 300 climbed 1 per cent.

Economic data showed that Japan’s economic output had rebounded more than expected in the third quarter, while China’s retail sales rose at the fastest pace in 2020, to above pre-pandemic levels.

“The upshot is that the negative shock to [China’s] labour market and service sector from Covid-19 now appears to have fully reversed,” said Julian Evans-Pritchard, senior China economist at Capital Economics. “We expect a period of above-trend economic growth in the coming quarters.”