Elders CEO Mark Allison.

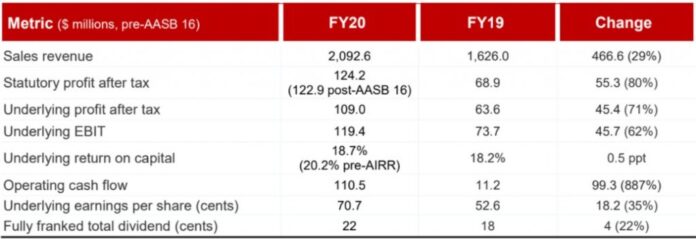

AUSTRALIAN agribusiness Elders has reported a statutory profit after tax of $122.9 million in the 12 months to September 2020, paying a share dividend of 13 cents.

Elders chief executive officer Mark Allison said shareholders now had a business “that can make good money in a bad year and great money in a good year.”

Elders also announced a fully-franked final dividend of 13 cents per share, taking total dividends paid for the year to 22 cents fully franked, up 22 percent or 4 cents on the previous year

In a year marked by drought, bushfire and the COVID-19 pandemic, Elders reported underlying earnings before interest and tax (EBIT) of $119.4m, representing an increase of 62pc on FY19. Underlying earnings per share (EPS) of 70.7 cents reflects a 35pc increase on FY19.

The company said the results were achieved despite drought and bushfires in the first half of the year and without any government assistance in the form of JobKeeper or other COVID-19 support measures.

Mr Allison attributed the outcome to the company’s Eight Point Plan strategy, combined with its nimble response to the year’s extraordinary challenges that arose throughout the year.

“Our solid business foundations and strict financial discipline, together with a commitment to ensuring the safety and prosperity of clients, communities and staff across Australia, allowed us to succeed despite challenging operating conditions in FY20,” he said.

Elders’ return on capital (ROC) of 18.7pc was 0.5 percentage points up on FY19. If the effect of the Australian Independent Rural Retailers (AIRR) acquisition is excluded, ROC is 20.2pc, in line with the 20pc ROC hurdle Elders set itself as part of the Eight Point Plan Strategy.

Gross margin growth and cost control

The company said its dividends result was driven by gross margin growth across all state geographies and products, combined with continued cost control and capital allocation discipline.

Elders’ acquisition and integration of leading rural supplies wholesaler AIRR added $44 million in wholesale gross margin, which Mr Allison said was well in excess of projections. Elders said it also made excellent progress on its backward integration strategy, selling more of its own branded products at higher margins.

High livestock prices offset soft wool market

Within its agency services division, higher livestock prices more than offset the soft market for wool. Elders’ real estate services division achieved strong growth, while its financial services division delivered above acquisition case growth for the livestock in transit delivery warranty product.

In FY20, Elders closed out its second Eight Point Plan, designed to produce consistent financial returns through the agricultural cycles and delivering on its advantage of being a pure-play agribusiness, Mr Allison said.

“Our FY20 results highlight the resilience of our business, the benefits of our diversification across both geographies and products, and our acquisition strategy,” he said.

In FY21, Elders embarks on a new, third, Eight Point Plan.

“Under our newly launched Eight Point Plan, we have again set ambitious financial goals – we are targeting 5 to 10pc growth in EBIT and EPS through the agricultural cycles at a compelling ROC of 15pc.

“In addition, in this plan, we have introduced new non-financial goals around sustainability and brand trust,” Mr Allison said.

“Also new is the systems modernisation program – a multi-year investment in a new, best of breed operating platform that will improve client experience and enable internal efficiencies.”

The company said safety is an important feature of the new Eight Point Plan and in FY20, Elders reported two lost time injuries (LTI), compared to nine in FY19.

“We are proud of the improvement in Elders’ safety record but, nonetheless, we strive for zero workplace injuries,” Mr Allison said.

Sustainability will be a priority, too, with Elders rolling out internal initiatives and practical offerings for customers in FY21.

“Elders will focus on developing its new, authentic industry-leading sustainability program across health, safety, community, environment and governance to drive profitability, and build a better business for customers, employees, regional and rural Australia, and other stakeholders to associate with, invest in and work in,” Mr Allison said.

FY21 outlook shows growth opportunities

Pointing to forecasted increases in summer crop plantings, Mr Allison said Elders expected demand for crop protection and fertiliser to recover.

Analysts, he said, were forecasting cattle prices to remain relatively high, if softer than the record highs of FY20. Elders was also working on the assumption that reduced consumer demand for apparel and disrupted clothing supply chains and raised levels of unsold textiles and raw fibres, would likely suppress wool prices in the near-term.

The company believed demand for farmland would continue to be high, while potential farmland sellers were deferring selling decisions due to COVID-19 uncertainty, underpinning ongoing strong farmland values in FY21.

Significant growth opportunities exist to gain market share by serving new customers, in new geographies with our multiple product and service portfolios. Elders will remain adaptable as the on-going impacts of COVID-19 continue to minimally disrupt key inputs across the industry.

You can find the Elders FY20 annual report and ASX report here.